The car buying process is ever-evolving as the industry adapts to the needs of the shopper. And today’s shopping is happening more and more on the Internet. Here at Downey Credit Solutions we try to make the process as easy as possible for you: the shopper. You can learn more about how the process works over at our How It Works page or maybe a pick up a few tips or frequently asked questions over at our Blog. We try to be as transparent as possible and make it as easy as possible for you get approved for your car loan. You can simply fill out our online application and you’ll know whether or not you’re approved without ever having to visit a dealership.

Below is a great article showing a snapshot of today’s car-buying process and one customer’s 900+ digital interactions along the way to purchasing a vehicle.

*Note: The following information was originally published over at Think With Google by Lisa Gevelber.

It’s no surprise that consumers turn to digital—especially mobile—as they shop for a car. But thanks to new data from Luth Research, we can see exactly how (and how much) digital shapes the auto customer journey. Check out the 900-plus digital interactions one consumer had leading up to her lease.

Auto marketers know that the average research timeline for a new car purchase can span months. Within that time, countless intent-driven micro-momentsoccur when consumers turn to their devices to answer a question or to address a need. Whether it’s a question about which car is the safest, which will fit a family of five with all their gear, or what the lowest monthly payment can be, these intent-driven moments are often Google Searches; and how auto brands respond in these micro-moments shape car buyers’ decisions.

But what exactly happens during those months of research? What types of exploration do consumers conduct? What do actual micro-moments look like?

Through new clickstream data provided by Luth Research’s opt-in panel (illustrating the order and pages a user visited), we are now able to answer those questions by analyzing the searches, clicks, website visits, and video views that make up one individual’s path to purchase. The result is a granular view of how the key auto shopping moments play out in one consumer’s car-buying process.

![]()

Meet Stacy

Stacy is a 32-year-old mother of two. At the time of her search, she drove a mid-size SUV that fit her family of four. But with a third child on the way, she needed a new car that would fit three car seats, and so she had to decide between leasing a larger SUV or going with a minivan.

A Detailed Look at Stacy’s Car-Buying Journey

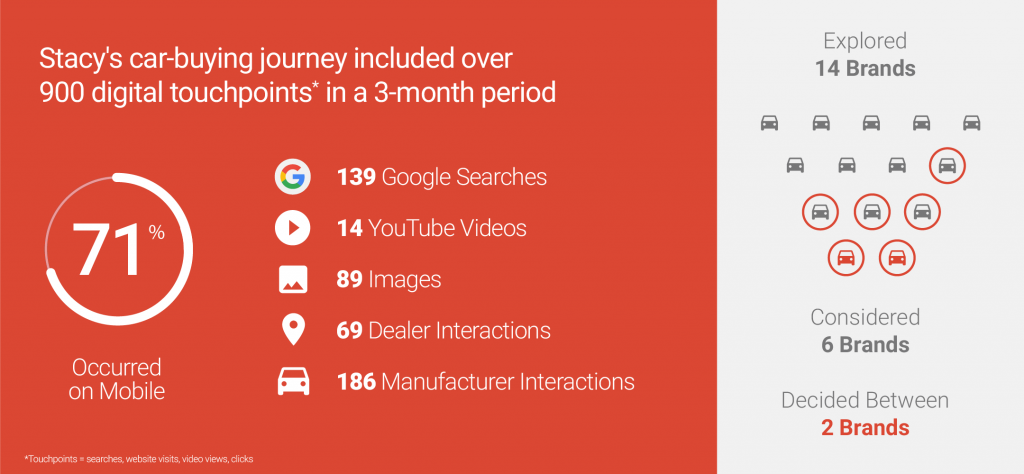

During the three-month period leading up to her decision to lease a car, Stacy’s research included over 900 digital interactions where she intentionally sought out information related to an auto lease or purchase.

71% of Stacy’s digital interactions occurred on mobile.

These interactions—which took the form of searches, visits, video views, and clicks—were on Google, YouTube, manufacturer websites, dealer websites, and review websites.

In those which-car-is-best, is-it-right-for-me, can-I-afford-it, where-should-I-buy-it, and am-I-getting-a-deal moments, Stacy turned to Google Search. Throughout the course of her research, Stacy conducted 139 Google Searches. Those are 139 instances where she intentionally sought out information, presenting 139 opportunities for auto marketers to meet her there with relevant and useful content that could shape her decision.

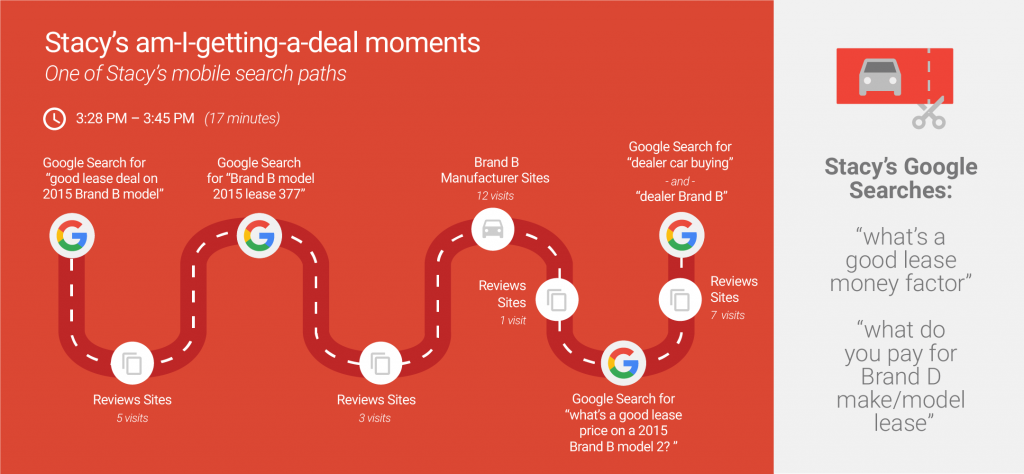

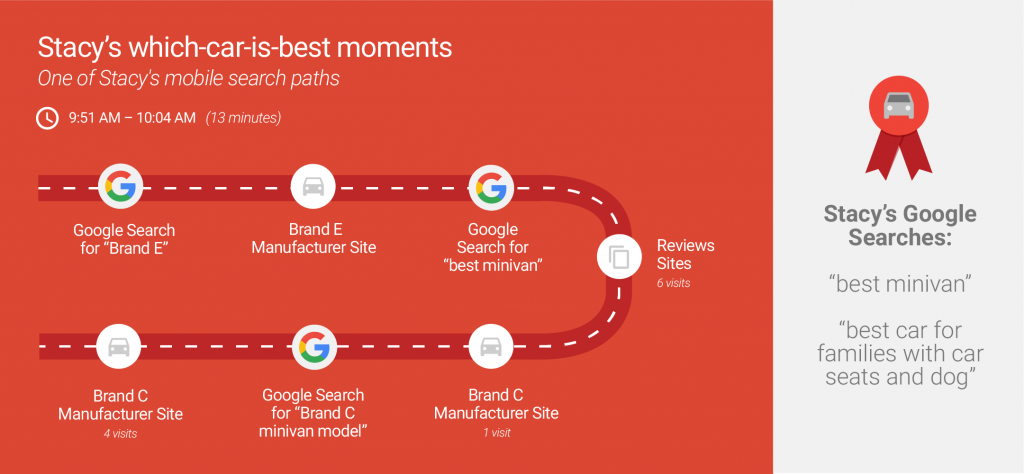

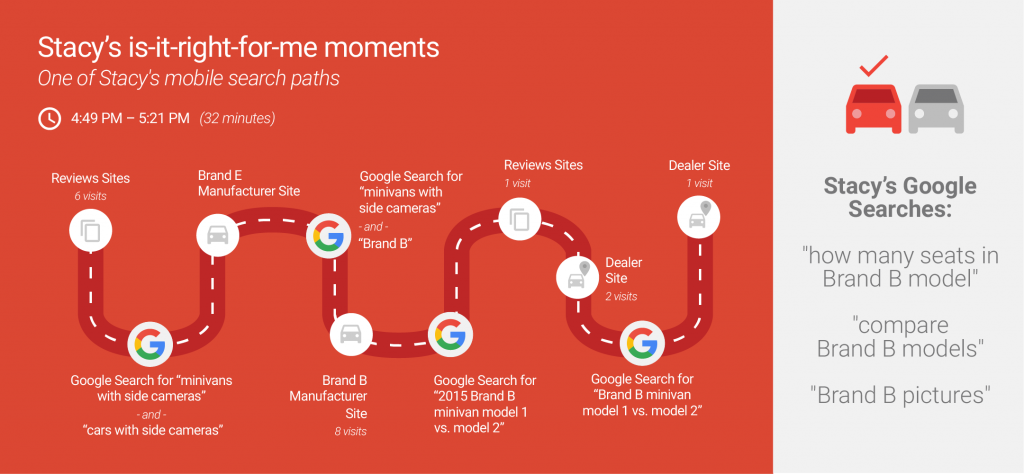

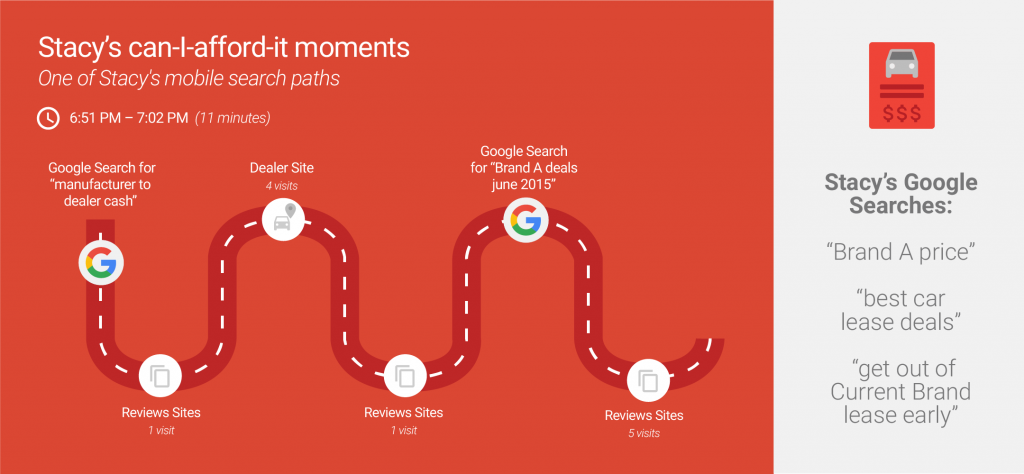

Here we walk through what those micro-moments looked like for Stacy, with examples of her actual mobile search paths and resulting actions.

Stacy’s which-car-is-best moments

Six out of 10 car shoppers enter the market unsure of which car to buy.2 Stacy started out focusing on family friendliness and safety, which led her to consider several brands and models.

Stacy’s is-it-right-for-me moments

As shoppers start to weigh practical considerations (like seating capacity and number of airbags, for instance), they start to determine their checklist of important features. Stacy’s checklist included fitting three car seats and a sliding middle row.

Stacy’s can-I-afford-it moments

As shoppers narrow down their options, cost consideration comes into play. Stacy explored pricing and payment options that were right for her, including: price points less than $30,000, comparisons of leasing vs. buying, lease exchange programs, and the trade-in value of her current SUV.

Stacy’s where-should-I-buy-it moments

Though much of the car-buying process has moved online, the visit to a dealership remains a crucial step for many car buyers. In fact, search interest for “car dealerships near me” has doubled in the past year.3 As Stacy explored nearby dealerships, she also considered local inventory, deals, and specials.

Stacy’s am-I-getting-a-deal moments

Though many am-I-getting-a-deal moments take place at the dealership, Stacy spent time researching deals both on the lot and off. She researched lease money factors, read about how she might forgo a dealer altogether, and crowdsourced actual prices paid for different brands and models so that she could show up prepared.